Navigating the mortgage maze with ease

Are you a first-time buyer looking to take the exciting leap into homeownership? Mortgage and Finance Arena, we understand that buying your first home is a significant milestone, and we’re here to make the mortgage process as smooth as possible for you.

Understanding Mortgages

A mortgage is a loan specifically designed to help you purchase a property. Here’s a breakdown of the types of mortgages available for first-time buyers in the UK:

- Fixed-Rate Mortgages: These mortgages offer a stable interest rate for a set period (typically 2, 5, or 10 years), providing predictable monthly payments. (Popular if you want to know exactly what you are paying each month and no worry of your payment increasing)

- Variable-Rate Mortgages: With variable rates, your interest can fluctuate based on the Bank of England base rate. While they may start lower than fixed rates, they carry the risk of increasing. (not popular with First Time Buyers)

- Shared Ownership: This option allows you to buy a share of a property (typically between 25% and 75%) and pay rent on the remaining share, making it more affordable. You will see the % you can buy on agents details

Steps to Buying Your First Home in the UK

- Evaluate Your Finances: Begin by assessing your financial situation. Check your credit score, calculate your savings, and determine how much you can afford for a deposit and monthly payments. (we can obtain your credit report to help you with this)

- Research Government Schemes: Look into various initiatives designed to help first-time buyers, such as Lifetime ISAs, Help to buy Mortgage Guarantee scheme and shared ownership schemes.

- Get Pre-Approved for a Mortgage: Securing a mortgage in principle from a lender will give you a clear idea of your budget and show sellers you are a serious buyer. (Estate agents like that you have got a Mortgage Approved in Principal when you start to make appointments to view houses.

- Find Your Ideal Property: Consider your needs, such as location, size, and amenities. Engaging with a knowledgeable estate agent can significantly ease this process.

- Make an Offer: Once you find a property you love, your estate agent will help you make a competitive offer based on the market conditions. Our Mortgage advisers can guide you with this too.

- Finalise Your Mortgage: After your offer is accepted, work with us to finalise your mortgage. Be prepared to provide necessary documentation, including proof of income, ID etc. We will also help you source a Solicitor for the purchase.

Why Choose Mortgage and Finance Arena?

At Mortgage and Finance Arena we are committed to helping first-time buyers navigate the mortgage landscape in the UK. Our experienced advisers provide tailored advice, competitive rates, and a variety of mortgage options to suit First Time Buyer needs.

Start Your Journey to Homeownership Today!

If you ready to embark on your journey to owning your first home? Contact Mortgage and Finance Arena today for a free consultation. Our dedicated team is here to guide you through every step of the mortgage process!

Working with thousands of lenders to find the right fit…

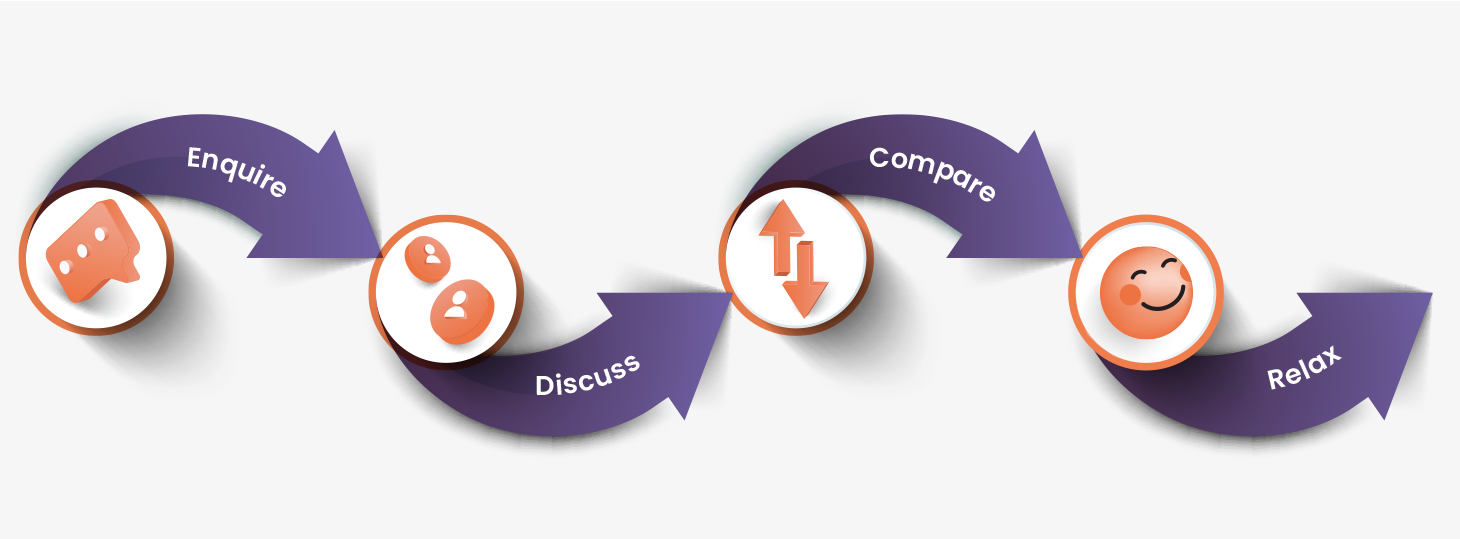

It starts right here…

We love to hear from you, give us a call, or fill in our contact form so we can see where you’re at. The more details the better!

One of our advisers will then find out about what you’re looking to do, discuss your options and answer any questions you may have.

Your adviser will search through thousands of lenders.

Your adviser will find the best option for you and help you arrange things.

The guidance to buying first home.

Need more help? →What Is the minimum down payment required for a mortgage?

Some lenders are offering a 5% deposit although you are likely to get a better interest rate if you can afford to put a bigger deposit down.

What is a help-to-buy scheme and how does it work?

This scheme offers and equity loan where the government lends first time buyers money to purchase a new build home – you need at least 5% deposit.

What additional cost should I be aware of when buying my first home?

Some additional costs in the home buying process can be the cost of valuations, legal fees and in some cases stamp duty.

Book an appointment

Book an appointment Mortgage calculator

Mortgage calculator