Remortgages in Derby & Derbyshire

Call our team on: 01332 300 300

Reap the rewards of remortgaging

There are many different reasons why you might be looking to remortgage your home. An application for a re-mortgage application may be more simple than when you purchased the property but getting the best rates, deals and the reason for wishing to remortgage can be the tricky part.

That’s why we have a team of expert advisers ready to help you! Our team has over 7 decades of experience working with remortgages, helping our customers to secure a competitive remortgage that is tailored to individual circumstances.

* It is important to consider the implications of adding your debts onto your mortgage. Your home may be repossessed if you do not keep up repayments on your mortgage.

Working with thousands of lenders to find the right fit…

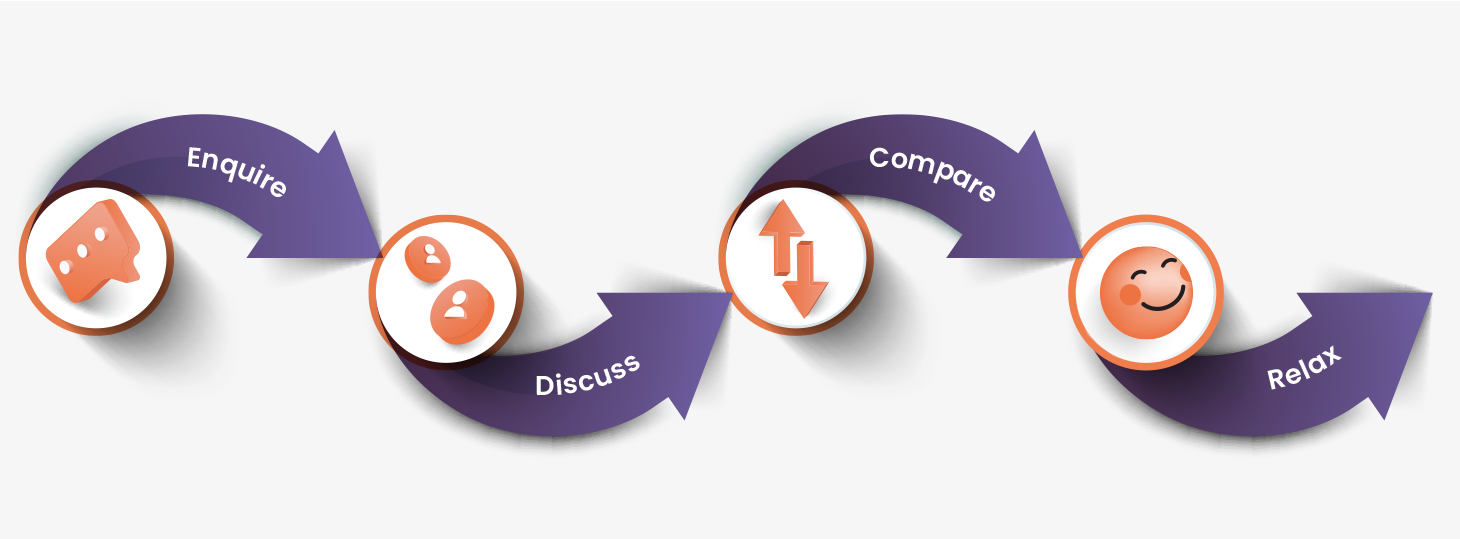

It starts right here...

We love to hear from you, give us a call, or fill in our contact form so we can see where you’re at. The more details the better!

One of our advisers will then find out about what you’re looking to do, discuss your options and answer any questions you may have.

Your adviser will search through thousands of lenders.

Your adviser will find the best option for you and help you arrange things.

The guidance to remortgages.

Need more help? →Can I get a better interest rate by remortgaging?

If you fixed your mortgage and since doing so the rates have been reduced you may be able to get a better deal – we would check if you have any early repayment charges to pay.

What are the costs and fees?

We will always look to get you a mortgage with no or low fees. This may be that you get a free valuation as an example.

How much can I borrow?

This depends on your income and outgoings – we can assess this for you!

Book an appointment

Book an appointment Mortgage calculator

Mortgage calculator