Embracing financial freedom

As you enter a new chapter in life, it’s essential to explore financial options that support your goals and provide peace of mind. Equity Release Mortgages sometimes known as a Life Time Mortgage, offer a flexible and practical solution for individuals aged 55 and above, allowing you to unlock the equity in your home and make the most of your hard-earned assets.

We will delve into the intricacies of equity release mortgages, providing you with a clear understanding of how they work and the benefits they offer. Whether you’re seeking additional funds for retirement, home improvements, or simply to enhance your quality of life, later life mortgages can be a powerful tool to achieve your financial objectives.

Equity Release Mortgage

An Equity Release Mortgage is the most popular equity release option. An Equity Release Mortgage is a loan that is paid as a tax-free lump sum and is secured against your home, meaning you still retain ownership.

You will eventually need to pay back this loan, with interest, but it won’t be repayable until your property is sold when you pass away or go into long term care. If you get a Equity Release Mortgage as a couple, this is when the second applicant reaches these events.

An Equity Release Mortgage is more flexible but bear in mind the interest will accrue, you can clear some interest monthly or at a time of your choosing, to decrease the final cost. Anything value left from the sale of your property is passed down to your beneficiaries.

To note: A lifetime mortgage/Equity Release Mortgage will be secured against your home.

Equity Release Mortgages are available to people over 55 years old and the percentage that can be released is based on:

Working with thousands of lenders to find the right fit…

It starts right here…

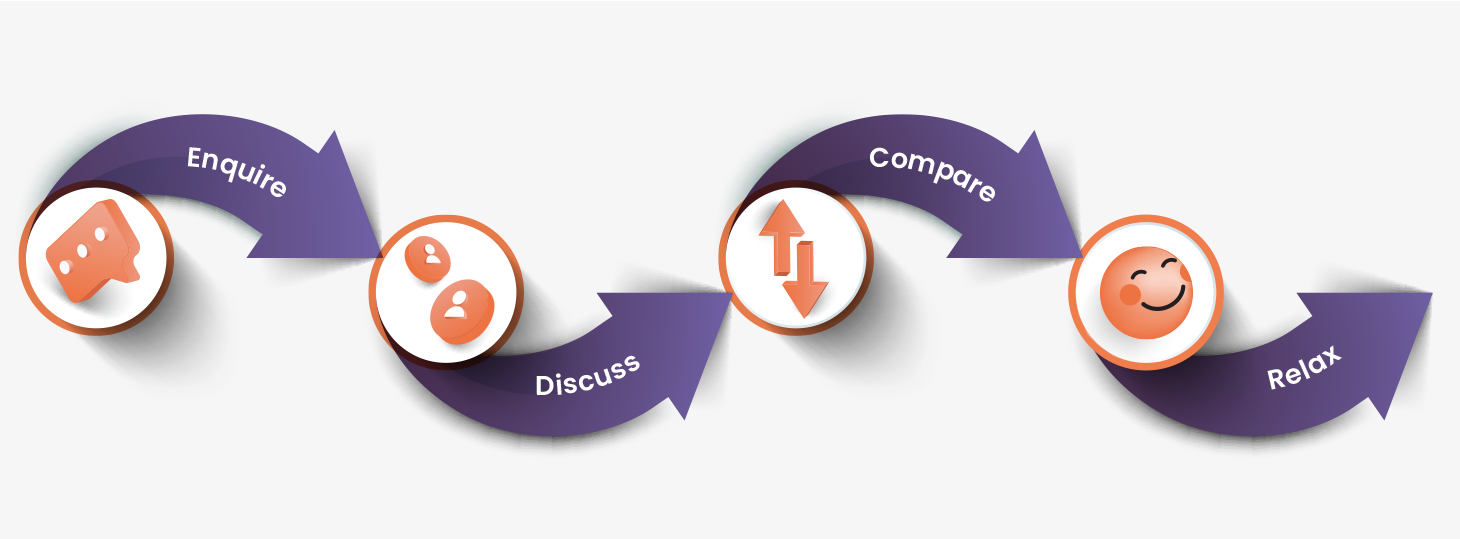

We love to hear from you, give us a call, or fill in our contact form so we can see where you’re at. The more details the better!

One of our advisers will then find out about what you’re looking to do, discuss your options and answer any questions you may have.

Your adviser will search through thousands of lenders.

Your adviser will find the best option for you and help you arrange things.

The guidance to Equity Release mortgages.

Need more help? →What is a equity release mortgage?

This type of mortgage is designed for individuals who are aged 55 or older. It provides a way to access the equity built up in your property, allowing you to release a portion of its value as a lump sum or in smaller installments.

How does is differ to traditional mortgages?

This type of mortgage often isn’t income assessed and you have the option to ‘roll up’ interest rather than make monthly repayments – we can provide detailed illustrations to show how this will impact your equity.

What is the maximum age limit to qualify?

There are no upper age limits. It’s important to note that while there may be no upper age limits, lenders will still consider other factors when assessing your eligibility for a later life mortgage.

Book an appointment

Book an appointment Mortgage calculator

Mortgage calculator